Table of Contents

- Executive Summary: 2025 and Beyond

- Technology Overview: Jig Injection Molding Explained

- Key Drivers Fueling Adoption in Microfluidics

- Market Forecasts: 2025–2030 Growth Projections

- Leading Manufacturers and Industry Players

- Application Spotlight: Life Sciences, Diagnostics, and Beyond

- Cost Efficiency and Production Scale Advantages

- Innovation Pipeline: Materials and Process Developments

- Regulatory Landscape and Standardization Efforts

- Future Outlook: Opportunities, Challenges, and Strategic Recommendations

- Sources & References

Executive Summary: 2025 and Beyond

As of 2025, jig injection molding has emerged as a pivotal technology in the fabrication of microfluidic devices, driven by growing demand in biomedical diagnostics, environmental monitoring, and pharmaceutical research. The technique, which utilizes custom jigs to precisely align and support micro-scale molds during injection molding, addresses critical challenges in the mass production of intricate microfluidic channels—namely, achieving high fidelity, repeatability, and cost-efficiency at scale.

Key industry players are accelerating investments in automated jig systems, significantly reducing cycle times and minimizing defects associated with manual alignment. For instance, companies such as ZEON Corporation and Nemera are actively developing advanced polymer materials and precision tooling for microfluidics, directly supporting customized jig molding solutions. These advances enable production of devices with feature sizes below 100 microns, essential for next-generation lab-on-a-chip applications.

Recent developments in digital design and simulation software, integrated with mold manufacturing, further enhance the repeatability and scalability of jig injection molding. The adoption of Industry 4.0 principles—including real-time process monitoring and data analytics—by companies like ENGEL and ARBURG facilitates continuous process optimization, reducing waste and enhancing throughput for microfluidic device manufacturers.

The ongoing miniaturization trend in diagnostics, particularly in point-of-care testing, is expected to bolster the microfluidics market through at least 2028. Manufacturers are responding by refining jig injection molding workflows to accommodate higher volumes and tighter tolerances. The result is a noticeable shift from prototyping via traditional soft lithography to scalable production using rigid thermoplastics, improving biocompatibility and chemical resistance.

Looking ahead, the next few years will likely see further integration of automation, in-line quality control, and novel materials in jig injection molding. Partnerships among tooling specialists, polymer suppliers, and microfluidic device OEMs are anticipated to accelerate, enhancing both innovation and supply chain resilience. As regulatory standards for diagnostic devices become more stringent worldwide, the traceability and process control enabled by jig injection molding will position it as a preferred method for medical-grade microfluidic production.

In summary, jig injection molding is set to underpin the industrialization of microfluidic devices through 2025 and beyond, enabling faster, more reliable, and economically viable production for rapidly evolving life science and diagnostic markets.

Technology Overview: Jig Injection Molding Explained

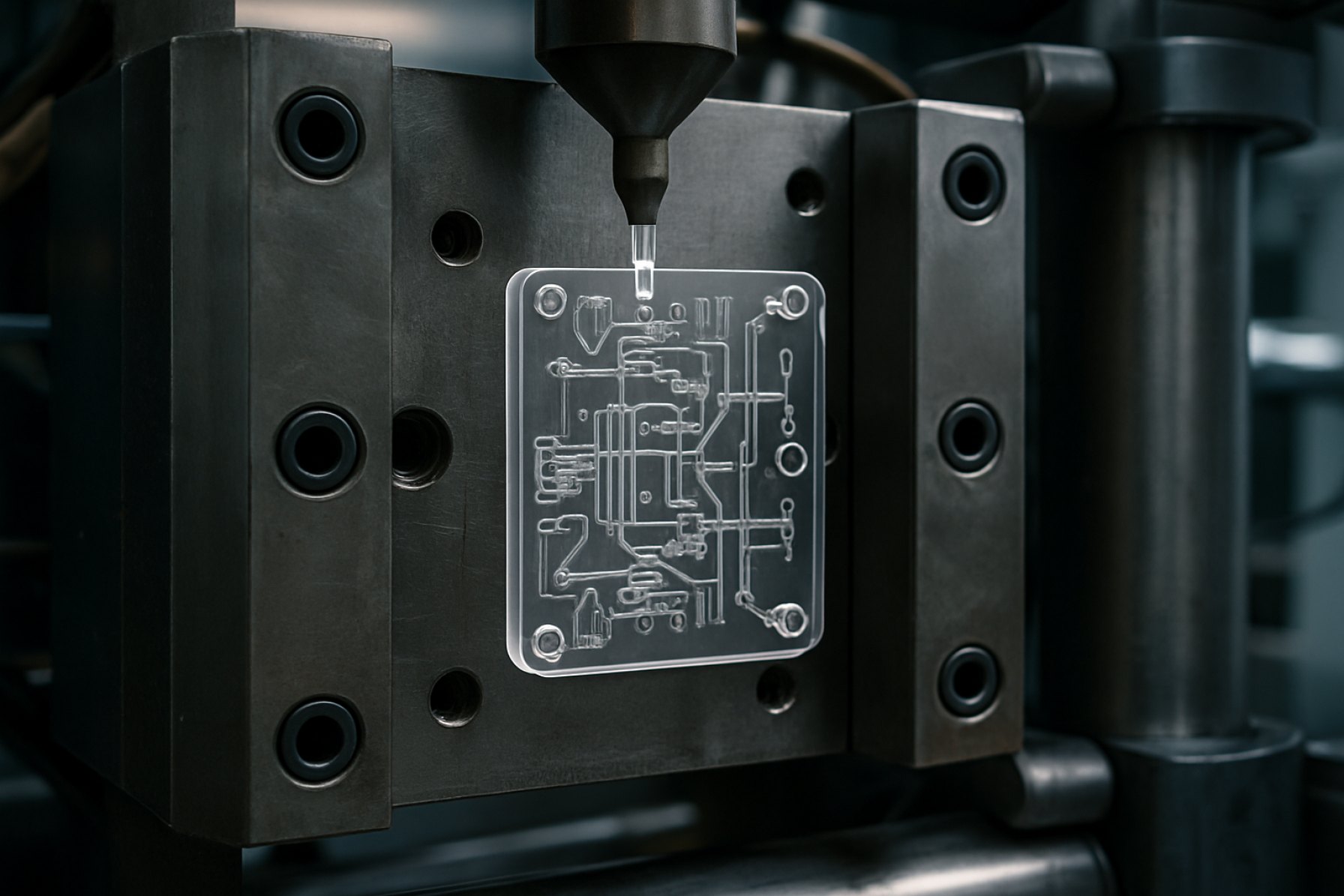

Jig injection molding is an advanced manufacturing process that is gaining increasing relevance in the production of microfluidic devices, particularly as demand for high-precision, high-throughput, and cost-effective solutions accelerates into 2025 and the coming years. In this context, jig injection molding refers to the adaptation of conventional injection molding techniques, using custom-designed jigs (fixtures) to achieve the intricate geometries and micron-scale features required for microfluidic chips. This approach addresses key challenges associated with the fabrication of microchannels, wells, and valves—critical elements in diagnostics, drug discovery, and point-of-care testing.

The core principle of jig injection molding involves the use of precision-engineered jigs that hold and align mold inserts with extreme accuracy during the injection cycle. This ensures that micro-scale features are faithfully reproduced in thermoplastic substrates such as cyclic olefin copolymer (COC), polymethyl methacrylate (PMMA), and polystyrene (PS). Unlike traditional lithography or soft lithography, which can be cost-prohibitive or limited in scalability, jig injection molding is designed for mass production without sacrificing the fidelity of critical microfluidic structures.

Technological developments in 2024–2025 focus on enhanced mold fabrication, improved temperature control, and optimized polymer flow, all intended to minimize defects such as warping or incomplete channel formation. Companies specializing in micro-scale injection molding, such as Microfluidic ChipShop and Dolomite Microfluidics, have invested in modular jig systems that enable rapid mold exchange and prototyping. This modularity is particularly relevant for accelerating the iteration cycles demanded by the fast-evolving life sciences and diagnostics markets. Furthermore, automation integration—especially robotic handling and in-line metrology—is being increasingly incorporated to ensure consistent part quality and traceability.

A notable trend in 2025 is the push for “design for manufacturability” (DfM) in microfluidics, where device concepts are co-developed with jig and mold design to facilitate reliable mass production from the outset. Industry bodies such as Microfluidics Association are promoting standards and best practices for both jig design and process validation, fostering interoperability and quality assurance across the supply chain.

Looking ahead, the outlook for jig injection molding in microfluidics is robust, with expectations for further reductions in per-unit costs, increased use of multi-material molding, and broader adoption in applications such as organ-on-chip and wearable diagnostics. Key players continue to expand their capabilities in response to global healthcare and biotechnology demands, positioning jig injection molding as a cornerstone technology in the scalable manufacturing of next-generation microfluidic devices.

Key Drivers Fueling Adoption in Microfluidics

The adoption of jig injection molding for microfluidic device fabrication is accelerating in 2025, driven by several converging factors that are reshaping both the microfluidics and polymer manufacturing sectors. One of the primary drivers is the rapidly increasing demand for high-volume, cost-effective production of microfluidic chips, especially for applications in point-of-care diagnostics, cell analysis, and environmental monitoring. As the global healthcare industry continues to seek scalable solutions for infectious disease testing and personalized medicine, manufacturers are under pressure to deliver devices with high reproducibility, precision, and reduced unit costs.

Jig injection molding addresses these requirements by offering enhanced process control and repeatability. The jig—a custom fixture used during the molding process—ensures tight tolerance alignment and consistent part quality, which is critical when fabricating microchannels and chambers at the micrometer scale. This capability is particularly valuable for companies producing devices with complex fluidic architectures or requiring integration of multiple materials. Industry leaders such as Nordson Corporation and Sumitomo (SHI) Demag have highlighted the role of high-precision molding systems and specialized jigs in achieving the stringent dimensional accuracy demanded by next-generation microfluidic platforms.

Sustainability and material innovation are also fueling adoption. Polymers like cyclic olefin copolymer (COC) and cyclic olefin polymer (COP) have become industry standards for microfluidic devices due to their optical clarity and biocompatibility. Jig-based injection molding allows for efficient processing of these advanced materials, minimizing waste and supporting initiatives for greener manufacturing. Major resin suppliers such as TOPAS Advanced Polymers and ZEON Corporation are actively promoting materials tailored for microfluidic applications, aligning with industry efforts to reduce environmental impact.

Automation and digitalization are further amplifying the benefits of jig injection molding. The integration of Industry 4.0 technologies—such as real-time process monitoring, in-mold sensors, and data-driven quality control—enables manufacturers to optimize cycle times, reduce defects, and achieve greater production scalability. Companies like ENGEL Austria and ARBURG GmbH + Co KG are at the forefront of deploying smart injection molding solutions tailored to the unique needs of microfluidics manufacturers.

Looking ahead, the outlook for jig injection molding in microfluidics remains robust. Ongoing advances in mold design, material science, and process automation are expected to further drive adoption through 2025 and beyond, supporting the expansion of lab-on-chip technologies across healthcare, life sciences, and environmental sectors.

Market Forecasts: 2025–2030 Growth Projections

The market for jig injection molding in the context of microfluidic device production is positioned for robust expansion through 2025 and the subsequent years leading up to 2030. This growth trajectory is fueled by escalating demand for miniaturized, high-performance diagnostic and analytical devices in fields such as point-of-care testing, drug discovery, and environmental monitoring. The unique capability of jig injection molding to enable high-precision, repeatable, and scalable fabrication of microfluidic structures is central to its adoption in commercial and research environments.

Industry stakeholders, including leading polymer microfabrication specialists and microfluidics solution providers, are investing in advanced tooling and process automation to meet the requirements of mass production. Companies such as ZEON Corporation and DuPont have continued to enhance their capabilities in polymer molding and specialty materials, offering solutions well-suited for microfluidic platforms. Additionally, injection molding equipment manufacturers like ENGEL and ARBURG are refining machine precision, automation, and mold design to support the intricate geometries and tolerances demanded by microfluidic applications.

Through 2025, the market is expected to witness an annual growth rate in the high single digits to low double digits, driven by rising investments from both public health agencies and private diagnostics developers. The COVID-19 pandemic underscored the need for rapid, high-volume manufacturing of disposable diagnostic cartridges, which continues to drive interest in microfluidics and corresponding fabrication technologies. The expansion of personalized medicine and decentralized healthcare models worldwide further supports the scaling up of microfluidic device manufacturing. Regions such as North America, Western Europe, and East Asia are anticipated to remain at the forefront, given their established manufacturing ecosystems and ongoing investments in life sciences.

- Material Innovation: Companies are expected to introduce new polymer resins with enhanced optical clarity, chemical resistance, and biocompatibility, aligning with the requirements of next-generation microfluidic devices (DuPont, ZEON Corporation).

- Automation and Digitalization: Automated jig systems and Industry 4.0 integration are forecast to improve throughput, reduce cycle times, and increase quality consistency (ENGEL, ARBURG).

- Market Diversification: Beyond healthcare, sectors such as food safety, environmental monitoring, and chemical analysis are anticipated to adopt microfluidic solutions, broadening the addressable market for jig injection molding providers.

Looking ahead to 2030, the convergence of material science advances, process automation, and expanding application areas is projected to sustain a healthy growth trajectory for jig injection molding in microfluidics, with leading manufacturers poised to capture a greater share of the global device production landscape.

Leading Manufacturers and Industry Players

Jig injection molding has emerged as a critical manufacturing approach for high-precision microfluidic devices, and the competitive landscape in 2025 is shaped by advances in tooling, automation, and material science. Leading manufacturers are responding to increased demand from diagnostics, life sciences, and point-of-care testing sectors, where microfluidic devices require stringent tolerances and reproducibility.

Among industry frontrunners, Nordson Corporation continues to expand its presence through specialized injection molding systems and integrated jig solutions. Nordson’s capabilities in precision dispensing and molding automation make it a preferred partner for OEMs seeking rapid prototyping and high-volume production of complex microfluidic chips.

Another significant player is Sumitomo (SHI) Demag, recognized for its all-electric injection molding machines tailored for the micro-manufacturing sector. The company’s focus on ultra-high accuracy and cleanroom-compatible equipment enables production of intricate microfluidic structures, supporting both R&D and commercial-scale device fabrication.

European supplier Microsystems UK Ltd remains a leader in the design and manufacture of micro-injection molds and jigs, particularly for medical and microfluidic applications. Their in-house toolmaking and metrology services position them as a key supplier for companies requiring full-cycle support—from mold design to finished device.

In Asia, Topworks Plastic Mold is making strides in custom jig and micro-injection molding for lab-on-chip and diagnostic platforms, leveraging advanced simulation and rapid tooling to reduce lead times and enhance component precision.

The industry is also witnessing collaborations between material innovators and molders; for example, ZEON Corporation supplies specialty polymers optimized for microfluidic device fabrication, working closely with molders to ensure compatibility and device integrity.

Looking ahead, from 2025 onwards, the sector is expected to see further integration of digital twins, process monitoring, and real-time quality control in jig injection molding workflows. Market leaders are investing in automation and AI-driven defect detection to meet stricter regulatory requirements and scale up production for next-generation diagnostic devices. As microfluidics becomes increasingly central to decentralized healthcare and environmental monitoring, leading manufacturers are poised to accelerate innovation and expand capacity worldwide.

Application Spotlight: Life Sciences, Diagnostics, and Beyond

Jig injection molding is rapidly gaining traction as a transformative manufacturing approach for microfluidic devices, particularly within life sciences, diagnostics, and emerging applications. As of 2025, the demand for high-precision, scalable, and cost-efficient fabrication methods is pushing manufacturers and research institutions to adopt advanced jig-based injection molding processes. These systems use precisely engineered jigs to align and secure molds, enabling the production of intricate microchannel architectures with tight dimensional tolerances—essential for reliable fluid handling in applications ranging from point-of-care diagnostics to organ-on-a-chip systems.

Companies such as ZEON Corporation and DSM are supplying high-purity polymers and developing new materials tailored for microfluidic applications, supporting the evolution of jig injection molding. The integration of cyclo olefin polymers (COP) and cyclo olefin copolymers (COC), known for their optical clarity and biocompatibility, has enabled the creation of robust and transparent microfluidic chips, further broadening their use in clinical diagnostics and biomedical research.

In 2025, the application scope of jig injection molded microfluidic devices is expanding beyond traditional life sciences. Leading contract manufacturing organizations like Gerresheimer and Nolato have ramped up their production capacities, delivering millions of disposable cartridges and test cassettes for molecular diagnostics, infectious disease testing, and personalized medicine. These advancements are particularly relevant in the wake of increased global investment in rapid diagnostic technologies and decentralized healthcare delivery.

Beyond diagnostics, microfluidic platforms fabricated via jig injection molding are seeing adoption in environmental monitoring, food safety analysis, and even next-generation electronics, where precise microchannel networks are required for cooling and fluidic logic. Manufacturers are leveraging automated jig handling systems and real-time quality monitoring—provided by companies such as Sumitomo (SHI) Demag—to ensure process repeatability and scale-up without compromising the fidelity of fine features.

Looking ahead, the next few years are expected to witness further integration of jig injection molding with Industry 4.0 practices and digital twins, enhancing both process optimization and traceability. As microfluidic devices become more complex and multifunctional, collaboration between material suppliers, mold designers, and device integrators will be crucial. This ecosystem approach is anticipated to unlock new frontiers in precision medicine, drug discovery, and portable analytical systems, solidifying jig injection molding as a cornerstone technology in the microfluidics sector.

Cost Efficiency and Production Scale Advantages

Jig injection molding is rapidly gaining traction as a preferred fabrication method for microfluidic devices, particularly as the industry pushes for higher throughput and cost efficiency in 2025 and beyond. The technique employs specialized jigs to secure and align micro-scale molds, enabling faster mold changes and reducing setup times compared to conventional injection molding. This approach is aligned with the growing need for scalable and economical manufacturing in applications such as diagnostics, drug delivery, and lab-on-a-chip systems.

One of the principal cost advantages of jig injection molding lies in its ability to significantly reduce the per-unit cost of microfluidic chips at medium and high production volumes. Unlike traditional soft lithography or CNC micromachining, which are both labor-intensive and expensive for large batches, jig injection molding leverages high-precision steel or aluminum molds and automated workflows. This allows for cycle times as short as a few seconds per part, optimizing throughput and minimizing labor input.

Industry leaders in microfluidic device manufacturing have reported that implementing jig-based systems has led to cost reductions of up to 60% for batches exceeding 10,000 units, primarily by streamlining the demolding and retooling process. Furthermore, the reusability and durability of the jigs and molds—often lasting for hundreds of thousands of cycles—help amortize tooling costs over expansive production runs. Companies such as Toppan and Zeon Corporation have actively invested in high-precision molding infrastructure to support the growing demand for affordable, mass-produced polymer microfluidic devices.

Looking ahead, the integration of jig injection molding with in-line quality control and high-speed automation is expected to further enhance production scalability and consistency. As device architectures become more complex, manufacturers are investing in advanced jig designs that enable multi-cavity molds and rapid prototyping without sacrificing accuracy. This capability is especially relevant for emerging markets, where demand for point-of-care diagnostics is projected to surge, necessitating millions of disposable devices annually.

By 2027, industry analysts forecast that jig injection molding will account for a majority of polymer microfluidic chip production, largely due to its unmatched blend of cost efficiency, scalability, and compatibility with a wide array of engineering plastics. As more companies expand their manufacturing capacity and refine jig-based methodologies, the overall market is poised for accelerated growth, delivering lower-cost, high-quality microfluidic solutions on a global scale, as evidenced by the ongoing investments and process optimizations at Zeon Corporation and Toppan.

Innovation Pipeline: Materials and Process Developments

Jig injection molding is emerging as a pivotal technique in the innovation pipeline for fabricating microfluidic devices, particularly as the demand for scalable, cost-effective, and highly precise platforms continues to grow into 2025. The method leverages specialized jigs to achieve alignment and reproducibility for micro- and nano-scale features, which are essential for fluidic control in lab-on-chip and point-of-care diagnostic applications. Recent advancements center on the development of new mold materials, refined temperature and pressure control, and integration with automation for high-throughput production.

One significant trend in 2025 is the adoption of advanced thermoplastics and engineered polymers tailored for biocompatibility and optical clarity, such as cyclic olefin copolymer (COC) and poly(methyl methacrylate) (PMMA). These materials are supplied by leading polymer manufacturers like SABIC and Evonik Industries, who are expanding their specialty polymer portfolios to meet the stringent requirements of microfluidic device fabrication. These polymers offer low autofluorescence and chemical resistance, making them particularly suited for diagnostic and analytical applications.

Process developments are being driven by precision molding equipment manufacturers. Companies such as ARBURG and ENGEL are introducing injection molding machines with enhanced micro-molding capabilities, including multi-cavity jigs and in-mold sensors for real-time process monitoring. This allows for tighter tolerances and repeatability in producing complex microfluidic architectures. Additionally, the integration of Industry 4.0 technologies is becoming standard, with machine learning algorithms optimizing cycle times and reducing material waste.

Another noteworthy innovation is the hybridization of jig injection molding with post-processing techniques such as laser micromachining and plasma surface treatment, which companies like Toppan and Microfluidics MPT are actively developing. These combined processes enable the fine-tuning of microchannel dimensions and surface properties, further enhancing device performance for applications in genomics, cell analysis, and environmental monitoring.

Looking forward, the next few years are expected to see continued investment in material science and process automation, with an emphasis on sustainability and circular economy principles. Recyclable polymers and energy-efficient molding processes are being prioritized by both established manufacturers and emerging startups. In summary, jig injection molding for microfluidic devices is set to gain further traction, underpinned by cross-disciplinary innovation and a robust supply chain of materials and precision equipment.

Regulatory Landscape and Standardization Efforts

The regulatory landscape for jig injection molding in the production of microfluidic devices is evolving rapidly as the technology becomes increasingly central to diagnostics, life sciences, and point-of-care applications. In 2025, regulatory agencies and industry groups are intensifying efforts to establish robust guidelines and standards that address the specific challenges posed by micro-scale fabrication, material compatibility, and device performance.

In the United States, the U.S. Food and Drug Administration (FDA) has been updating its guidance to reflect the growing adoption of microfluidic devices manufactured via precision molding techniques, including jig injection molding. The FDA’s Center for Devices and Radiological Health (CDRH) now emphasizes the need for comprehensive risk assessment, traceability, and validation protocols tailored for microfluidics, given their role in in vitro diagnostics and emerging personalized medicine platforms. These updates affect both device manufacturers and contract manufacturing organizations that utilize jig-based injection molding for rapid prototyping and volume production.

In parallel, international standards organizations are accelerating harmonization initiatives. The International Organization for Standardization (ISO) is actively developing new standards and updating existing ones, notably ISO 13485 for medical device quality management and ISO 14644 for cleanroom environments. Recent working group activity has focused on integrating requirements specific to microfabrication, including the reproducibility and dimensional tolerances achievable with jig injection molding, and the traceability of polymer materials used in device fabrication.

Industry consortia such as the SEMI association, which traditionally focuses on semiconductor manufacturing, have launched committees addressing the convergence of microelectronics and microfluidics. These efforts aim to standardize terminology, metrology, and performance benchmarks for components produced by advanced injection molding processes, ensuring interoperability and quality across the supply chain.

For manufacturers, compliance with these evolving regulations and standards is becoming an essential competitive differentiator. Companies specializing in precision molding equipment, such as ENGEL and ARBURG, are increasingly collaborating with device developers to ensure their technologies and processes are audit-ready and compatible with regulatory expectations for microfluidic medical devices.

Looking ahead, the regulatory landscape is expected to further tighten over the next few years as authorities address the dual imperatives of innovation and safety. Stakeholders anticipate more explicit requirements around process validation, material biocompatibility, and in-process monitoring for jig injection molding, particularly as microfluidic devices expand into critical diagnostics and therapeutics. This ongoing evolution underscores the importance of continuous engagement with standardization bodies and regulators for all participants in the microfluidic device ecosystem.

Future Outlook: Opportunities, Challenges, and Strategic Recommendations

Looking ahead to 2025 and the subsequent years, jig injection molding for microfluidic devices is poised for notable advancements, propelled by the increasing demand for rapid prototyping, scalable manufacturing, and cost-effective production in the life sciences and diagnostics sectors. The convergence of miniaturization trends in biomedical research and the need for high-precision disposable devices is fueling interest in this specialized molding technology.

Key opportunities are emerging as stakeholders seek alternatives to traditional photolithography and soft lithography methods, which, while precise, are often limited by high costs, lengthy turnaround times, and scalability constraints. Jig injection molding offers a compelling solution, enabling the mass production of complex microfluidic architectures with reproducible feature fidelity and shorter cycle times. Industry leaders such as DSM and Nordson Corporation are actively expanding their micro-molding portfolios, leveraging advanced jig systems designed for the precise alignment and fabrication of micro-scale channels and features critical for lab-on-chip and point-of-care (POC) diagnostic devices.

Recent data from manufacturers indicate a heightened focus on integrating automation and digital quality control within jig injection molding workflows. For instance, companies like Sumitomo (SHI) Demag are investing in smart injection molding machines tailored for microfluidic applications, incorporating real-time monitoring and adaptive process controls to ensure consistent yields and traceability. Moreover, material suppliers such as Covestro are developing specialized resins and polymers with improved biocompatibility, optical clarity, and low autofluorescence, addressing critical requirements for microfluidic device performance.

However, the sector faces several challenges as it matures. Maintaining micron-scale tolerances over large production volumes remains technologically demanding, particularly as device geometries become more intricate. Tooling costs for high-precision jigs and molds, as well as the need for specialized maintenance, can be significant barriers for smaller enterprises. Furthermore, as regulatory standards evolve for diagnostic and clinical microfluidic devices, manufacturers must invest in robust validation protocols and traceability systems to ensure compliance.

Strategically, stakeholders are advised to prioritize partnerships with established micro-molding specialists and to adopt modular, automated jig systems capable of rapid reconfiguration for evolving device designs. Continued investment in material innovation, process analytics, and workforce training will be essential for maintaining competitiveness. The outlook for 2025 and beyond suggests that companies effectively navigating these opportunities and challenges will play a pivotal role in shaping the next generation of scalable, high-performance microfluidic technologies.

Sources & References

- ZEON Corporation

- Nemera

- ARBURG

- Microfluidic ChipShop

- Dolomite Microfluidics

- Microfluidics Association

- Sumitomo (SHI) Demag

- TOPAS Advanced Polymers

- DuPont

- Sumitomo (SHI) Demag

- Microsystems UK Ltd

- DSM

- Gerresheimer

- Nolato

- Toppan

- Evonik Industries

- Microfluidics MPT

- International Organization for Standardization

- Covestro